What are Incoterms? International commercial terms in practice

Are you selling goods abroad? Or perhaps you’re importing from China, India, the United States, Canada, or any other country in the world? If so, you should know that Incoterms – International Commercial Terms – can be a powerful tool in your business. These international trade formulas not only define but also protect the interests of both the seller and the buyer.

Incoterms were created to regulate key aspects of international trade, such as transportation costs, insurance, customs duties, and even the moment responsibility transfers from seller to buyer during the shipping process.

In short: they are globally recognized rules that clearly define who is responsible for what at each stage of the shipment in international trade.

In this article, we’ll explain what Incoterms are, how they work in practice, and why understanding them is essential – especially if you run a business and want full control over your supply chain, cost management, and risk allocation.

Incoterms 2020 – what are they?

Incoterms are a set of commercial trade rules first published by the International Chamber of Commerce (ICC) in 1936. Since then, they have been regularly updated to reflect changes in global trade practices.

The most current version is Incoterms 2020, which came into force on January 1, 2020.

How do Incoterms work?

What do these rules actually do? Simply put, they determine who bears the costs and risks during the transport of goods. This includes:

- transport arrangements,

- export and import customs clearance,

- cost allocation – including freight, insurance, and customs fees,

- liability for loss or damage to goods.

Importantly, Incoterms are voluntary – their use in a sales contract depends entirely on the mutual agreement between the buyer and the seller. These rules do not apply to freight forwarders, shipping companies, or intermediaries – only to the two contracting parties.

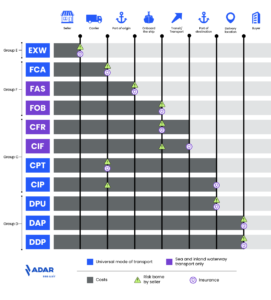

The current version includes 11 standardized Incoterms rules, categorized based on the type of transport involved – some apply exclusively to sea and inland waterway transport, while others can be used regardless of the transport mode.

Each Incoterm rule must specify a key location – for example, a port, warehouse, or terminal. This point marks the transfer of responsibility and risk between parties. Interestingly, Incoterms can also define when ownership rights to the goods transfer, which is crucial from an accounting and insurance standpoint.

Line by line, Incoterms clarify all the essential elements that could otherwise lead to disputes in international transactions. That’s why it’s worth knowing them well and using them wisely in your contracts.

Types of Incoterms

The Incoterms 2020 rules are divided into two main groups: those that apply to any mode of transport, and those specific to sea and inland waterway transport.

There are a total of 11 clearly defined Incoterms rules, each specifying who bears the costs and responsibilities of the shipment – and when the risk transfers from the seller to the buyer.

Below is a simplified explanation of each rule – stripped of excessive jargon and focused on practical application.

EXW – Ex Works (pickup directly from the seller)

The most minimalistic of all Incoterms.

The seller makes the goods available at their premises – for example, in a warehouse or factory. Everything else – transportation, customs, risk – becomes the buyer’s responsibility. This rule is ideal for sellers who want to have as little on their plate as possible.

FCA – Free Carrier (delivery to the buyer’s carrier)

The seller delivers the goods to a specified location and hands them over to the carrier chosen by the buyer. This location could be a warehouse, terminal, airport – depending on the agreement and how the delivery terms are defined between the parties.

From the moment the goods are handed over to the first carrier and loaded onto the transport vehicle, the buyer assumes full responsibility.

In the 2020 version, it is possible to agree on issuing an “on board” bill of lading even under this rule.

FAS – Free Alongside Ship (at the port of departure)

FAS applies exclusively to maritime and inland waterway transport. The seller delivers the goods alongside the ship – right at the quay – at the port designated by the buyer. From that moment on, the buyer assumes all responsibility and handles further transportation.

The seller is required to complete export customs clearance before the goods reach the port.

In practice, this means that the seller delivers the cleared goods and places them next to the ship in the agreed port. At that point, all responsibility and costs transfer to the importer.

FOB – Free on Board (loaded onto the ship)

FOB also applies to maritime and inland waterway transport. Under this rule, the seller not only delivers the goods to the port, but also loads them onto the ship. Once the goods cross the ship’s rail, the risk passes to the buyer.

The goods must be loaded onto a vessel appointed by the buyer. The risk and responsibility transfer from seller to buyer only at the moment of loading. Until then, the seller is responsible for all operations, including export customs clearance.

CFR – Cost and Freight (cost and freight paid by the seller)

In CFR, the seller bears the cost of transport to the port of destination and arranges the freight contract, but responsibility is transferred at the moment the goods are loaded onto the ship in the port of origin. From that point, the risk lies with the buyer, even if the goods are still on their way to the designated destination.

In short: the seller pays the transport cost to the destination port, but responsibility for the goods passes to the buyer as soon as they are loaded onto the ship. Insurance? That’s the buyer’s concern.

CIF – Cost Insurance and Freight (cost, insurance and freight paid by the seller)

CIF works similarly to CFR, but here insurance is also paid by the seller. Although the buyer takes on the risk once the goods are loaded, they are not required to insure the goods themselves. The seller is responsible for covering insurance costs up to the destination port.

CPT – Carriage Paid To (transport paid to a specific place of destination)

Under the CPT rule, the seller covers the cost of transport to the agreed point, but risk transfers to the buyer much earlier – at the moment the goods are handed over to the carrier (the first carrier).

It’s important to know the exact moment the goods are handed over to the carrier, because cost and responsibility don’t always go hand in hand.

CIP – Carriage and Insurance Paid (transport and insurance paid to a specific place of destination)

CIP is an extension of the CPT rule – here too, the seller arranges and pays for transport, but is also obliged to provide insurance coverage for the goods.

The buyer assumes risk after the goods are handed over to the carrier, but the insurance provided by the seller remains valid up to the specified place of destination.

DPU – Delivered at Place Unloaded (delivery of goods and unloading)

The seller is responsible for the entire transport – including unloading – up to the named place of destination, according to the buyer’s instructions.

This is the only rule where unloading is the responsibility of the seller. The buyer receives the goods on-site, ready for further handling.

DAP – Delivered at Place (delivery of goods, without unloading)

Under the DAP rule, delivery takes place when the goods reach the agreed location, but unloading is not included.

The seller is responsible for the entire transport, but the buyer must handle unloading and import customs formalities if required.

DDP – Delivered Duty Paid (delivered, duty paid)

DDP is the rule in which the seller bears the majority of costs and is responsible for all stages of the transport.

The seller must handle everything – from preparing the goods and arranging transport, to export customs clearance and delivery to the buyer. They are also responsible for customs duties and taxes.

The buyer doesn’t have to worry about any formalities and all the costs – they receive the goods ready for use at the destination.

Incoterms 2020 Update

Incoterms 2020 is already the eighth version of the rules since their initial introduction by the ICC in 1936. This revision has been in force since January 1, 2020, and, like the 2010 version, can be applied in both international and domestic trade.

The updated version maintains the division of the rules into two categories:

- for all modes of transport,

- for sea and inland waterway transport only.

Key changes include:

- The renaming of the DAT rule to DPU – the new name “Delivered at Place Unloaded” more accurately reflects that the place of delivery does not have to be a terminal.

- Modification of the FCA rule – it is now possible for the buyer to request the carrier to issue a bill of lading with an “on board” notation, which facilitates documentary transactions (e.g., through letters of credit).

- Greater clarity – the responsibilities of both parties are now more precisely defined, making the rules easier to interpret and apply in practice.

The main idea? To make life easier for exporters and importers – especially in today’s global trade environment, where any misunderstanding can cost time, money, and nerves.

Summary

The Incoterms rules were created to organize and standardize the principles of international trade, particularly in the context of goods transportation. Their main goal is to clearly define which party – the seller or the buyer – bears the cost of transport, customs duties, insurance, and at which point responsibility for the goods transfers from one party to the other.

Importantly, using Incoterms is not mandatory – it’s a voluntary agreement between the parties, which can be included in the commercial contract. These rules apply exclusively between the seller and the buyer, meaning freight forwarders or transport companies are not direct participants.

Incoterms regulate matters related to the delivery of goods – from the moment they are prepared by the seller, through export customs clearance, to transport, possible insurance, and delivery to the buyer.

Frequently asked questions (FAQ)

Which Incoterms apply to sea and inland waterway transport?

Four Incoterms 2020 rules apply exclusively to sea and inland waterway transport. These are:

- FAS (Free Alongside Ship) – delivery of the goods alongside the vessel at the port of loading.

- FOB (Free On Board) – loading the goods onto the vessel.

- CFR (Cost and Freight) – transport cost to the destination port is paid by the seller.

- CIF (Cost, Insurance and Freight) – same as CFR, but with additional insurance paid by the seller.

These rules are most commonly used for bulk and non-containerized cargo transported by sea or inland waterways – e.g. by river barge.

All other Incoterms (7 out of 11) can be used for any mode of transport, including multimodal transport.

What is the difference between DDP and DAP?

The main difference between DDP (Delivered Duty Paid) and DAP (Delivered at Place) lies in who is responsible for paying customs duties and taxes.

Under DDP, the seller takes care of all customs formalities, including the payment of import duties. Under DAP, the seller delivers the goods to the destination, but the buyer must handle the import clearance and cover all related costs.

What is the difference between EXW and FCA?

EXW (Ex Works) is the rule where the seller fulfills all obligations once the goods are made available at their premises – e.g. a warehouse. Everything else, including transport, customs clearance, and risk, falls on the buyer.

FCA (Free Carrier) requires slightly more involvement from the seller – they deliver the goods to the carrier at an agreed location and may also assist with export formalities. FCA is a more flexible and practical rule in real-world trade scenarios.

What is the difference between CIF and CFR?

What is the difference between CFR (Cost & Freight), CIF (Cost, Insurance, Freight)? Both rules apply to maritime transport and differ in one key aspect: insurance.

In CFR (Cost and Freight), the seller pays for the transport to the destination port, but the buyer is responsible for insurance cover of the goods.

CIF (Cost, Insurance and Freight) also requires the seller to pay for insurance, although risk – just like in CFR – passes to the buyer once the goods are loaded onto the ship.